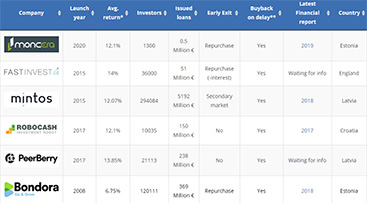

Moncera is a new crowdlending platform launched in 2020 offering personal loans from the well-known loan originator Placet Group that was founded almost 15 years ago. The platform offers attractive returns(more than Placet Group offers on Mintos), no pending payments, one-click exit and something called a cooling-off period on your

Category: Crowdlending

Continue to read below to find out how you can reduce the following 10 risks in peer to peer lending: Platform default, Loan originator default, Borrower or project defaults, Overlapping loan originators, Hacking, Greed, Not making a final will, Investing in foreign currency and Not staying updated on crowdlending. Peer

The P2P crowdlending Excel spreadsheet can calculate your income, cash flow, risk distribution, XIRR and more. To achieve the highest possible return its necessary for you to actively manage your crowdlending investments, according to your investment strategy. Some of the factors that can reduce your returns are low interest rates,

Crowdlending, also sometimes referred to as P2P lending, brings together private individuals looking to make a profit and companies or other individuals seeking loans, through an online marketplace to cut out the middlemen, resulting in better conditions for both the borrower and the lender. Below we will take a look