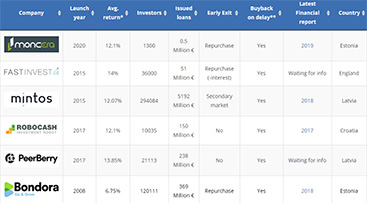

Use the drag and drop tool below to Compare P2P lending platforms in Europe. It’s possible to compare up to 3 platforms at the same time. You will be able to see information about when the platforms were founded, how many loans they have issued and their average yearly return and much more. Furthermore, you will be able to see more specific options for an early exit, buyback, location of the platforms and if it’s possible to transfer money to the platform using Transferwise, Revolut or similar. You will get the best overview by using a computer or by turning your phone horizontally. Simply drag the logo of the platform to the square “Drag here” and all the information will be shown to you. Press invest now to invest in the platform.

If you just want a simple overview to compare P2P lending platforms you can find a sortable table here. Also, consider downloading the P2P lending Excel spreadsheet which can assist you to compare P2P lending platforms. The P2P lending Excel spreadsheet will calculate the exact average income using XIRR as well as your risk distribution between different P2P lending platforms.

This page is updated at least once a month(Latest update September 2022)

Drag Drag Drag

Here

Here

Here

* The information provided regarding the yearly average interest is based on the information from the P2P lending platforms which might calculate the numbers differently.

** The Buyback guarantee might only apply to a selection of the loans, so please chose your loans wisely. There is often no buyback on real estate investments, but you will in most cases have a guarantee in the property.

Don’t hesitate to contact us if you have suggestions for this page, ideas for new platforms to add or if you find incorrect information.

Use Chrome or Firefox to view this page. Internet Explorer is not supported.