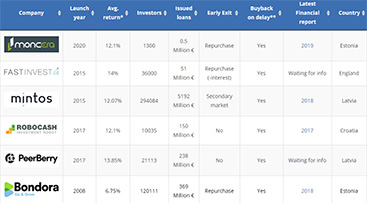

Moncera is a new crowdlending platform launched in 2020 offering personal loans from the well-known loan originator Placet Group that was founded almost 15 years ago. The platform offers attractive returns(more than Placet Group offers on Mintos), no pending payments, one-click exit and something called a cooling-off period on your loans. CEO Dmitri Pavlov from Moncera has kindly agreed to an interview. Read the interview below to find out how this platform fits into the current market, how it’s going to compete with similar crowdlending platforms and find out what that the cooling-off period is really about.

– For the readers that are not yet familiar with Moncera, can you briefly explain the concept and how the platform fits into the current crowdlending market?

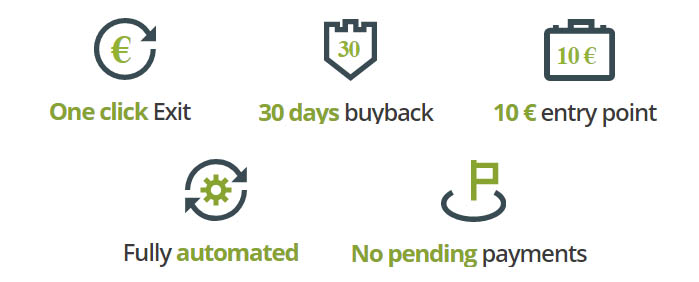

– Moncera is peer-to-peer lending platform. We offer our investors great opportunity to invest in consumer loans and earn profit. We believe that investing should be accessible to everyone, no matter how much money or experience one has. Therefore we are happy to be part of the fintech companies who are revolutionizing the dynamics of banking, lending and investing. We contribute to the new financial era by providing a trustworthy peer-to-peer lending platform. Our team is very experienced in the financial field and we take great pride in offering a safe and easy marketplace of consumer loans. That is why Moncera is one of the few platforms with Buyback Guarantee, 1 Click Exit and attractive returns.

-What is the competitive advantage of Moncera over other similar crowdlending platforms?

-Moncera provides loans from the high rated Loan Originator Placet Group with the following benefits:

– Bank settlements each day, i.e. that no Pending payments

– One click exit – instant liquidity for 0,5% from remaining principal

– 30 days buyback including accrued interest.

-What type of loans do you offer at your platform?

-Today, investors have at their disposal consumer loans with a maturity of 3 to 72 months. All our loans are coming with 30-days buyback guarantee, having a 1-click exit option and interest rates starting from 12%, which is higher than on other Marketplace where our LO’s are presented. You can start investing with just 10€ and don’t have to be an investment guru to earn profit.

-What considerations did you have about entering the crowdlending market in a time where investors are not only concerned about COVID-19, but also about recent scams by platforms like Envestio and Grupeer?

-You can’t build a company (IT, legal, authorizations and etc.) for one day or even month. Development of Moncera started in September 2019, on that moment there wasn’t any scams or crisis. After 6 months, in March 2020, the Moncera platform was presented.

-How did you manage to grow to 1450 investors in such a short timeframe from starting Moncera?

We have invested heavily in advertising and continue to do that. At the beginning of our activity, we made a lot of mailings on many databases and surprisingly gave a good result. Most of those investors are from Estonia.

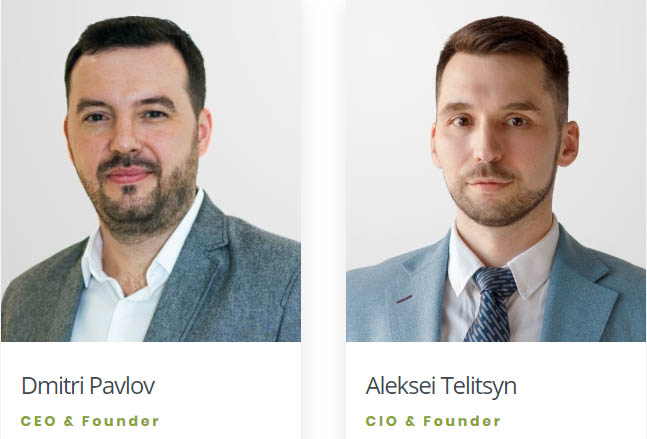

-Can you tell a little about the team behind Moncera?

-At the starting point of the project our team consists of Me (Dmitri Pavlov) as AML/Legal officer, Accountant, IT (Alexey Telitsyn) and Customer Support. We are going to recruit more staff in the nearest future.

My financial experience starts with Creditstar in 2008. Since 2015 I worked in Placet Group OU and been involved in the integration with Mintos. In September 2019 I started to develop Moncera. Alexey Telitsyn is the 2nd board member and founder of Moncera. Alexey has 20 years of IT experience. He worked in banks, developed and supported banking software, was engaged in the development of software for online stores, as well as financial projects related with Placet Group.

-Is it Moncera or the loan originator who guarantees the 30-day buyback guarantee?

– All guarantees are provided by Loan Originators.

-You have something called a cooling-off period on your loans. What is it and why do you have it?

-Cooling-off period is coming from “GOOD PRACTISE COMMON PRACTICE” recommendations that our investors have had a possibility to withdraw from the agreement and get back investments without any consequences. We offer 14 days cooling-off period for all investments.

-Why did you decide to use One-Click Exit as an option of early exit instead of a secondary market?

-One of our missions is to offer a service that allows our investors to feel safe and comfortable. We believe that having instant liquidity gives the investor confidence in the future, especially in such a difficult time.

The Moncera office located in the heart of Tallinn.

How will you make sure that you have enough capital for One-Click exits if a lot of investors make a bank run on your platform as we have seen recently on other platforms?

-We are doing Bank settlements each day. In case of “bank run” Placet Group is a very sustainable company and have enough liquidity to cover gaps in such case.

-Can you please explain the connection between Moncera and Placetgroup?

–Placet Group is not the owner of Moncera. There are personal relations with Placet Group shareholders. I may state that Placet Group reputation is very tough connected with the reputation of Moncera. And such a high rated company like Placet Group wouldn’t cooperate with the platform without being confident in its officials.

-What is the financial situation of your loan originator Placet Group?

-The financial situation of Placet Group is very stable. We are analyzing and monitor their financial reports all the time. Investors have an opportunity to check PlacetGroup reports by themselves on https://placetgroup.com/reports/2020

-Are you planning to add more loan originators to your platform?

We are not planning to add more Loan originators in the nearest future, instead of this, we wish to concentrate on existing LO’s to offer the best conditions on the P2P market.

-Is the Moncera platform regulated by any authorities?

Moncera OÜ has authorization for economic activity from the Estonian Financial Intelligence Unit. To obtain such authorization, company’s shareholders and its board members are going through the full process of checking their compliance with these positions.

-How is the current financial situation for Moncera?

-Moncera is profitable at the present moment and has enough capital to be a self-sustaining platform. Our revenues are coming from service fees to loan originators. At the end of May 2020 company equity was 40’700 EUR.

-If Moncera would go bankrupt, what would happen to the money of the investors?

-Moncera bankrupt is possible only if LO’s wouldn’t be able to fulfil its obligation. We are in cooperation with High-rated LO’s such as Placet Group, a company which was founded in 2005 and has a very strong financial results. The risk of Moncera insolvency is very low.

-What is the story about the name change from Bancera to Moncera?

-We have started the registration of Bancera trademark and the patent Office has recommended changing the name due to a similar name on the market in the financial sector. To avoid any doubts and future litigation we decided to change the name.

-How do you avoid pending loan payments? It can usually take days from the borrower repays until the money arrives on the investor’s account.

-We have agreed with all our Loan originators that we do bank settlement at least once a day. And if the situation requires us to, we can even make it twice pr. day. It helps us to avoid pending payments and we are sure that investors money is always on Moncera account.

-What are the short and long term goals of Moncera?

-Our main goal is the satisfaction of our Investors. We are doing everything to find an individual approach to each investor. We are always developing and presenting minor updates and innovations. One of our goals is to become regulated.

-Do you withhold tax for any countries? And can a tax statement be printed from the platform?

–Moncera is obliged to withhold tax only from residents of Estonia. Tax summary is available to download in investor’s personal account in „statement“ menu.

Visit the Moncera website to start investing already today.

Use the code FB34OG3 when signing up to get a bonus of 25EUR.

0 Comments