Crowdlending, also sometimes referred to as P2P lending, brings together private individuals looking to make a profit and companies or other individuals seeking loans, through an online marketplace to cut out the middlemen, resulting in better conditions for both the borrower and the lender. Below we will take a look at some of the good reasons to invest in P2P Crowdlending:

1) Attractive returns

Crowdlending usually offer very high interesting rates, it is not uncommon to get more than 12% per annum in Euros and even higher in other foreign currencies. The interest income is significantly higher compared to savings accounts and is getting higher and more stable returns compared to stocks. For example on most saving accounts in Europe, you will currently get below 1% per annum and the average long-term returns on stocks can averagely be up to 6-7% per annum. Even so, the average income from stocks may seem relatively high, keep in mind that some years are much worse. In 2007-2008 some stocks dropped as much as 30%.

2) Differentiation is reducing your risks

Differentiation is a very important part of investing. As the old saying goes “Don’t put all your eggs in one basket.” You don’t want to lose a big part of your investment because you did not differentiate. As an alternative to bonds, stocks, savings accounts etc. crowdlending is already a way of differentiating. Within crowdlending, there are as well many possibilities to differentiate and reduce your risks. It is among others possible to differentiate between countries, foreign currencies, loan/project type, as well as lending many small amounts to as many borrowers as possible. We recommend you to use the crowdlending Excel sheet to be able to calculate your distribution between all the platforms you have invested in, as well as interest and much more.

3) Low barriers of entry

There is a low barrier of entry for investors wanting to invest in crowdlending. While stock trading requires substantial resources it’s possible to get started in crowdlending with as little as 1€ and you can access the online marketplaces from your computer and mobile phone at home. This also means that young investors with limited financial means can start up their savings in crowdlending from early on.

4) Zero investment fees for crowdlending

Don’t let high costs eat away your returns. Unlike investing in stocks, bonds, funds or participating in other investment programs, there are no fees for the investor in crowdlending. Keep in mind that money you lose to investments costs rise exponentially over time due to the compound interest.

5) Early exit

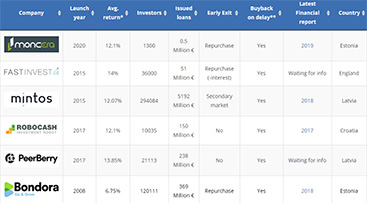

Something in your life changed and you want to withdraw part of your investment. An early exit in crowdlending is much easier for you compared to the stock market, where it can be necessary for you to realize your investment when it is at the lowest value. With the help of secondary markets in crowdlending is possible for you to sell out your investments early and sometimes even with a premium. Besides the secondary market, some of the online marketplaces also offer to buy back your investment against a small fee. You can check the conditions for an early exit at the drag and drop P2P platform comparison.

6) Short term investments

It’s possible to invest both short-term and long-term on the online marketplaces. One of the benefits with crowdlending is that some of the marketplaces offer you to invest your money for a duration as little as 1-30 days in consumer loans.

7) Stable cash flow

Since the loan takers are repaying you interest on a monthly basis you will be generating a steady income every month independently on how the often highly fluctuating stock market behaves. The income received can be reinvested in more crowdlending platforms or simple withdrawn. To comparison you will from most types of stocks only receive income when you sell them and if you really need to money you might be forced to sell your stocks when they are not at their highest value.

8) Buyback of delayed loans

Many of the loans on the marketplaces comes with buy back. Buyback means if a loan is delayed the loan originator will buy back the loan if the payments are delayed with 60 days or more including the outstanding interest (Can vary between loan originators). You can get a simple overview of the buyback conditions of the peer to peer platforms by checking the peer to peer platform comparison.

9) Become your own investment manager

Finally, crowdlending is also a good possibility for those who take an interest in managing their own finances from home while combining attractive returns, no fees, a high degree of differentiation and the possibility to track your own investments day by day. Furthermore, investors can utilize the huge lending market to divide their investments among hundreds of loans and multiple lending platforms, thereby minimizing the risks.

10) Rapid growth in crowdlending

Crowdlending has experienced rapid growth in the last few years and is now among the fastest-growing segments in the financial lending market. Don’t miss out on these great investment possibilities!

1 Comment

DMO

July 8, 2019 - 11:31 amSo true !