Continue to read below to find out how you can reduce the following 10 risks in peer to peer lending: Platform default, Loan originator default, Borrower or project defaults, Overlapping loan originators, Hacking, Greed, Not making a final will, Investing in foreign currency and Not staying updated on crowdlending.

Peer to peer lending platform defaults

There is always a risk that a peer to peer lending platform can default. Lendy that recently defaulted in 2019 is the most recent example. Evoestate wrote a blog post about some of the reasons for Lendys collapse. Lendy was a UK-based P2P platform that had more than 180 million EUR outstanding loans of the time of the default. In short, there were several reasons why Lendy failed. First of all, it was due to an unsustainable level of defaults and recoveries of loans, but high staff turnover, poor due diligence and a LTV (loan-to-value) that was artificially low didn’t help the situation.

Ponzi schemes / Scams

Besides platform defaults, Ponzi schemes should also be considered as a risk factor. Ponzi schemes in Crowdlending had in 2019 not yet occurred in Europe on a bigger scale, but it was a big problem in China that in 2015 had more than 3800 less regulated peer-to-peer platforms. The Chinese Police have shut down hundreds of fraudulent Platforms after investors lost millions of EUR invested in fabricated investment projects. In 2020 Europe also started seeing the Ponzi schemes with the platforms Envestio, Grupeer, Kuetzal and Monethera.

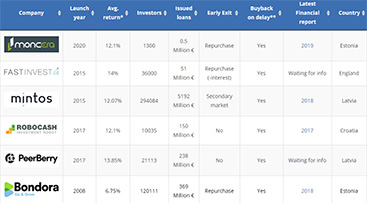

To migrate your risk of losing a big part of your crowdlending investments if a crowdlending platform folds, make sure you distribute your investments between different crowdlending platforms. You can use the Crowdlending Excel spreadsheet to calculate your distribution of funds and before you chose a new platform to invest in you can check the platform’s latest financial reports.

Loan originator defaults

The most recent defaults of a loan originator were the default of Rapido Finance in 2019 that was a loan originator on the peer to peer lending Mintos. The second most recent was Eurocent in 2017. In both cases, the loan originators could no longer live up to the buyback guarantee for delayed loans. Other loan originators also got into trouble in 2019, that so far did not end in default, one of these loan originators was Aforti that was represented on the crowdlending platforms Mintos and Viventor.

Always keep in mind that the buyback guarantee is only as strong as the loan originator itself. It’s not enough that you distribute your investments between different peer to peer lending platforms, it’s also important that you distribute your investment between different loan originators if you want to lower your investment risks. Furthermore its also important to stay updated on the financial situation of the loan originators. The platform Mintos keep their loan originators financial reports on their webpage as well as the rating of all the loan originators.

Borrower or project defaults

If a borrower does not have the capital to pay you back on time you risk losing your money. If a borrower on a platform like Bondora does not pay back on time collection of the debt will begin, so some of the outstanding debt can be recovered. On the platform Mintos, most of the loans will come with a buyback guarantee which means that if a borrower does not pay you back on time that buyback guarantee will kick in after 30-60 days and you will receive the principal as well as in most cases the interest for the delayed payments. The platform Crowdestor does not have buyback on all their projects but they have introduced a buyback fund in order to maximize the financial security for their investors. Crowdestor is devoting a commission of 1-2% from each funded project into their fund. In case of default, the platform will compensate all investors in a proportionate amount.

To reduce your risks with borrower defaults make sure to read everything about the loan taker. If it’s a private person you will be able to see details about employment status, age, the total sum of money borrowed, and if former repayments were paid on time. The same goes for projects, make sure to understand the project details, who are the owners of the project, and what guarantees does the project have of success, and what happens if the project fails. If you have invested in a property platform, it might not have buyback, but instead a guarantee in the property itself if this is the case make sure to check the LTV (loan to value) before investing.

Overall it’s important to keep in mind that if the loan originator fails, the buyback will fail too, but as long as the loan originator is able to live up to the buyback its an increased security for you. You can compare those platforms that offer buyback guarantee by going to the drag and drop comparison of crowdlending platforms.

Overlapping loan originators

Even so, you have distributed your peer to peer lending investment on separate crowdlending platforms you need to be aware that these platforms might have overlapping loan originators.

Example: the loan originator Aforti started having financial problems in 2019, the loan originator was represented on several platforms among these Mintos and Viventor.

You might think you have reduced your risk by allocating your funds to several platforms, but if several loan originators are overlapping, you risk losing a bigger part of your money. To reduce this risk its recommend to check which loan originators you are investing in on each platform to see if any of the loan originators are overlapping.

Hacking of peer to peer lending account

Overall the risk of your accounts getting hacked is still relatively low. But as peer to peer lending gain increased popularity and attention, the risk might be on the rise as it happened with cryptocurrency. After the huge increase in value for Bitcoins many cryptocurrency exchanges were hacked and a lot of people lost money as it recently happened in Japan in 2019. The invested money in crowdlending is still increasing and platforms like Mintos has already passed 4 Billion Euro in investments, which also catches the attention of people with bad intentions.

So what can happen if a person with bad intentions takes over your crowdlending investment account? Depending on the platform your money could potentially be withdrawn to another person’s account. In reality, it’s not very easy to do, since the crowdlending platform will normally always verify your bank account. Loans could also be sold with a huge discount resulting in a huge loss for you.

So what can you do to protect your investments? First of all make sure to use a strong password with a combination of lower and uppercase characters, symbols, and numbers. Not only should your password be strong, but you should also not repeat the same password on multiple crowdlending sites. If someone gets access to one of your reused passwords they will have access to everything. It’s also important that you have a strong password on your e-mail since your e-mail is often used to reset passwords of the platforms you are using. Secondly consider activating two-factor authorization, which increases security. Platforms like Mintos already have this feature activated. Last but not least be attentive to suspicious transactions on your account, even an unknown ingoing money transfer can be a sign of something that’s not right.

Greed

Your own greed is one of the biggest risks in P2P Lending as well as in other types of investments. On the quest for higher and higher returns, your own greed might lead to several risky investment decisions.

Investing more than you can afford to lose

Imagine that you for a very long time have saved up for a flat that you are planning to buy with your partner in one year. Tempted by the high-interest rates you invest all your savings in 3 different peer to peer lending platforms for one year. All your friends did it and it went fine, but this time one of the platforms went bankrupt and you might have lost one-third of your savings. Depending on the size of your savings this could set you back for several years.

Putting all eggs on one basket

The second risky decision you could take is to put all the eggs in one basket. Temped by the very high-interest rates of platforms like Crowdestor (that have a buyback fund) or Envestio you might consider adding all your funds in one crowdlending platform to get interest rates closer to 20% instead of closer to 10%. Usually the higher the interest rate the higher the risk. If something goes wrong with the platform you chose you are risking losing all your money.

Locking up your money in long term investments

The third risky decision you can take is to invest your money for long term investments without a possibility for an affordable early exit from the investment. If you suddenly will need the money before the money is available, it might be very expensive for you to release the money from the investment or find another source of capital.

CompareCrowdlending.com can not help you to evaluate how much money you can afford to invest. But we have made a tool that does not only give you an overview of the distribution of your investments it also shows you the month cashflow you so you will never risk having too much money locked up on long term investments. Check out the free peer to peer lending Excel sheet here.

Not making a final will/testament that includes your peer to peer lending investments

Did you ever ask yourself what will happen to your many different crowdlending investments the day you die? A sad possibility is that your relatives might not inherit any of it if nobody knows about your investments. Most of the foreign platforms will not report automatically to the tax authorities in your country which, will make it much more difficult to keep track of your investments. If you at the same time have used alternatives to your own bank, like money transfer services as Revolut, Paysera or N26 it becomes even more complicated to locate all of your investments.

To migrate the risk of your relatives never finding out about your crowdlending investments consider one of the following two options:

The first option is to make sure that your relatives know where you are investing, so make sure that the relevant relative(s) at least have the names of the platforms where you are investing. If you have a closer relationship you can also share the sum invested and/or the e-mails/passwords / two-factor access for the platforms as well.

The second option is to contact a lawyer and write a final will/testament where you mention the crowdlending platforms so your relative(s) can inherit your investments when you are no longer alive. Don’t forget to write some guidelines for your relative(s), so they know how to withdraw your investments in the best possible way.

Investing in foreign currency

Investing in foreign currency loans like Russian Rubles, Kazakhstani Tenge and Polish Zloty can be tempting with the often higher interest rates and the increased possibility to differentiate your loan portfolio. Your return can, however, be negatively influenced due to exchange fees and the development in exchange rates between your home currency and the foreign currency you are investing in. If you want to learn more about how the exchange fee, the exchange rates, and your investment time horizon influence your investments in foreign currency please read the blog post about foreign currency investments on Mintos.

The development in exchange rates can not be predicted since it depends on political and economic factors that will be described below. The best you can do is to stay updated on the news from the countries you are investing in. You can reduce the impact of the exchange fees by using services like Revolut or Paysera to exchange to and from foreign currency cheaper and you can use N26 to make free transfers in Euro to other crowdlending platforms.

Political and economic factors

Political and economic factors are a big part of the risks associated with crowdlending. Let’s imagine that you invested in the Envestio project with Crypto farming with a yield of 20%. What would happen with that investment if the price of Bitcoins fell with 75%? Would the project still be profitable? Investments in residential buildings from platforms like Evoestate and Bulkestate can also be influenced negatively by a drop in prices for residential buildings. Regulations concerning consumer loans can also change. Several countries consider making a cap of the interest rate for consumer loans. A limit on the interest rate for consumer loans can potentially negatively influence loan originator and thereby the investor. In 2014 the Russian Ruble took a hard hit after Russia got hit by sanctions at the same time as the oil price went down. If you had invested in Rubles before 2014, your investment would almost have been reduced to 50% in EUR terms. You can see the development in the different currencies offered by Mintos in the blog post “Foreign currency investments on Mintos.”

Almost all of the crowdlending platforms are relatively new. That’s why it’s not possible to predict the consequences of a financial crisis for the crowdlending platforms. The consequences of the financial crisis depend a lot of the region, type of loan/project, currency, and financials of borrowers/loan originators.

The best you can do is to follow political and financial news and adjust your investments accordingly. Also, distribute your investments between, different platforms, loan providers, countries, currencies etc.

Not staying updated on peer to peer lending

The final risk is not staying updated with the peer to peer lending companies you are investing in. You might miss out on the latest news on peer to peer lending, the latest cashback campaigns or even worse you might miss out on recently released financial reports or signs of the bankruptcy of one of the platforms.

To stay updated simply sign up to the newsletter below:

0 Comments